By Marlon Fawkes. Last Updated 28th June 2022. Welcome to our guide to AXA accident at work and insurance claims. If the other party in a motorcycle accident in which you suffered an injury was insured by AXA, you may be entitled to seek compensation by making a personal injury claim against the insurance provider. Even if you think you were partially liable, your claim for a motorcycle accident against AXA Insurance could still be valid and as such, you may be entitled to seek compensation for injuries and damages you suffered.

What’s included in this guide?

Our guide covers what losses and damages could be included in your claim, what evidence you need to provide to support your claim, and how a No Win No Fee solicitor can take all the worry of paying for legal representation when you need it the most, off the table.

Our guide covers what losses and damages could be included in your claim, what evidence you need to provide to support your claim, and how a No Win No Fee solicitor can take all the worry of paying for legal representation when you need it the most, off the table.

To find out how we can be of assistance, please get in touch on 0800 073 8801 today.

For more information on how to claim motorcycle accident compensation against AXA Insurance, please continue reading our guide by clicking on the sections below.

Select a Section

- A Guide On Motorcycle Accident Insurance Claims Against AXA Insurance

- What Are Motorbike Accidents?

- How Motorcycle Insurance Is Provided Through AXA

- Are You Able To Make An Injury Or Accident Claim?

- Motorcycle Accidents And Injuries Which Could Be Claimed For

- Am I Eligible to Make a Claim Against AXA Motorcycle Insurance?

- Should You Directly Contact An Insurance Company?

- How Insurance Companies May Assess Claims

- Could I Get A Better Settlement By Using A Solicitor?

- Calculator For Motorcycle Accident Insurance Claims

- Check If You Could Claim Special Damages

- How Our Accident Claims Specialists Could Help You

- No Win No Fee Motorbike Accident Claims Against Insurance Companies

- Talk To Us About Motorcycle Insurance Claims Against

- Helpful Links

A Guide On Motorcycle Accident Insurance Claims Against AXA Insurance

If you suffered any sort of injury in a motorcycle accident where the other party was insured by AXA, you could be entitled to seek compensation from the insurer by filing a personal injury claim against them.

Our guide provides essential reading on how to pursue a motorcycle accident claim against AXA Insurance. We cover the claims process and what evidence would be needed to support a personal injury claim for injuries and damage sustained in this type of road traffic accident. We also cover the following:

- How liability would be determined and whether a claim would be settled on a split-liability basis

- The importance of having both a police report and medical report when making a motorcycle accident claim against AXA Insurance

- We offer advice on how seeking legal representation could see a higher level of compensation being achieved when negotiating a settlement

- We explain the advantages of working with a No Win No Fee lawyer when making a personal injury claim

To discuss your claim with a member of our team, please get in touch today.

What Are Motorbike Accidents?

Bikers can be injured on the road in many ways, whether through an error they make or because of the negligence of another road user. The most common causes of a motorcycle accident on UK roads include the following:

- When changing lanes without paying enough attention

- Speeding

- Filtering

- Dooring

- When turning to the left

- Dangerous/poor road conditions

- Sudden, unexpected stops

- Inexperience

- Bike and equipment defects

- When negotiating a bend

- Loss of control

It is worth noting the majority of fatal accidents involving bikers occur on a Sunday, and that a high percentage of road traffic accidents happen during fine weather.

Injuries that could occur

Bikers typically come off worse when involved in a road traffic accident with the most common injuries sustained being as follows:

- Injuries to the head which includes concussion, brain damage and skull fractures

- Neck injuries

- Fractures to the face

- Injuries to limbs which includes hands, arms, legs, ankles, and feet

- Road rash which includes cuts, bruises, and abrasions

- Whiplash

As previously mentioned, motorcycle injuries tend to be more serious simply because of the lack of protection around them as compared to car drivers. A serious head injury or neck injury could be life-changing or fatal.

If you were involved in a motorcycle accident and you sustained any sort of injury, whether minor or more severe, you may be entitled to claim compensation if you can show another party was responsible. Should the party involved be insured by AXA, one of our expert solicitors can assess whether you have a strong case and would, once this is established, offer you No Win No Fee terms when claiming motorcycle accident compensation against AXA Insurance.

How Motorcycle Insurance Is Provided Through AXA

An AXA motorcycle insurance policy is underwritten by AXA Insurance UK Plc. They are regulated by the Financial Conduct Authority (FCA) and authorised by the Prudential Regulation Authority.

If you are injured in a bike crash caused by another road user who is insured through AXA, providing you have enough evidence to prove the other party was responsible, you could make a motorcycle accident claim against AXA Insurance. If you think you could be partially liable, you should not admit anything at the scene of the accident, but rather contact a member of our team because you could be entitled to compensation under a split liability claim.

Are You Able To Make An Injury Or Accident Claim?

Providing the party responsible for the accident holds a policy issued by AXA Insurance, a personal injury claim for compensation could be made against the insurance provider. You would need to provide enough evidence to prove your claim. However, as previously mentioned, you could still be entitled to compensation if you think you could have been partially responsible for the accident happening and the injuries you sustained.

This is known as ‘split liability’ which means you would share responsibility for the accident occurring. The level of motorcycle accident compensation you receive would be less than if another party was responsible and you did not contribute to the incident whatsoever.

To find out whether you have a valid personal injury claim following a motorcycle accident and whether you could make the claim against AXA Insurance, please speak to one of our advisers today.

Motorcycle Accidents And Injuries Which Could Be Claimed For

You may be able to claim compensation for damage to your property as well as for the injuries you sustained in a motorcycle accident, whether you were partially to blame or because the accident was caused through the negligence of another road user.

Examples Of Accidents On Motorcycles

The most common road traffic accidents involving motorcyclists include the following:

- Failing to look to see if the way is clear

- Misjudging the speed of another road user

- Failing to see a motorcyclist because they are in a mirror’s blind spot

- Running into a stationary motorcyclist

- Dooring

A motorcyclist may be injured in a road traffic accident because they made an error of judgement which could include the following:

- A failure to ‘predict’ that another road user is about to make a manoeuvre

- A failure to take notice of adverse weather conditions

- A failure to see hazards on the road

- Not paying attention to adverse road surfaces

- Being overconfident

- Inexperience

- A failure to negotiate a bend in the road

Examples Of Injuries Caused By Motorcycles

Because bikers have far less protection around them than their car driver counterparts, they are more at risk of sustaining serious injuries when involved in a motorcycle accident. If you suffered any sort of injury in a biker accident on the road, you may be able to claim compensation even if you think you may be partially liable. The sort of injuries you could claim for are as follows:

- Road rash

- Ankle injuries

- Foot injuries

- Leg injuries

- Arm injuries

- Hand injuries

- Neck injuries (Whiplash)

- Head injuries

If the other party has an AXA insurance policy, you could claim compensation for your injuries and damage sustained against the insurer. To find out how we could be of assistance in pursuing a motorcycle accident claim against AXA Insurance, please get in touch today.

Am I Eligible to Make a Claim Against AXA Motorcycle Insurance?

In order to make a successful personal injury claim, you will need to provide evidence. For a road traffic accident and injury you can collect evidence such as:

- Medical records of your injury

- Photos taken of your injury, or photos taken of damage to your property

- Photos taken at the scene of the accident

- Recordings such as CCTV footage or dashcam footage

- Contact details of witnesses to your accident

- Insurance and registration details of every party involved in the accident

- Police reports

Our solicitors have experience in settling road traffic accident claims and can help you collect this type of evidence to help strengthen your case.

They can also arrange a medical assessment, reach out to police for your accident report and collect and request possible CCTV footage on your behalf.

As a motorcyclist injured in a vehicle accident insured by AXA, injury claims may be possible if you are the no-fault driver. They have experience in successfully negotiating with insurance firms such as AXA over injury claims and can help you with your case. Call our advisors to find out if you could make personal injury claims against AXA Motorcycle Insurance.

Should You Directly Contact An Insurance Company?

You could contact AXA Insurance directly if you plan to seek compensation for injuries sustained in a motorcycle accident caused by a policyholder.

The reason many claimants choose not to seek legal representation when filing a personal injury claim is that the whole process can be daunting to anyone who does not have the necessary experience when it comes to negotiating with insurance providers

If the other party involved does not accept responsibility and AXA Insurance disputes your personal injury claim against them, it can make the process even more challenging. You could also find that the insurer offers you an initial settlement before your injuries have been correctly assessed by an independent medical professional. The result is that you could be offered far less than you really are entitled to.

For more information on how one of our solicitors can assist you in making a motorcycle accident claim against AXA Insurance, please call an adviser today on 0800 073 8801.

How Insurance Companies May Assess Claims

When you make a personal injury claim for injuries sustained in a motorcycle accident against AXA Insurance, they would investigate your claim to determine whether it is valid or not. The insurer would also want to establish liability and whether you may have contributed to the incident in some way. This is why it is so important to gather as much evidence as possible when making a claim for compensation and to be completely truthful regarding the events that led up to the incident.

AXA Insurance may reject a claim for compensation for the following reasons:

- You failed to get a police accident report

- You could not provide a medical report detailing the injuries you suffered

- You admitted you were at fault at the scene of the motorcycle accident

- The policyholder claims you were totally responsible for the motorcycle accident and the injuries you suffered

- You filed a personal injury claim too late and after the statutory time limit for personal injury claims had expired

To avoid delays and your personal injury claim being rejected by AXA Insurance, you should seek legal advice from a solicitor who has the necessary legal expertise to handle this type of claim.

Could I Get A Better Settlement By Using A Solicitor?

Insurers can offer you an early settlement if your motorcycle claim is not disputed. All too often this could be before the extent of your injuries have been recorded by a medical professional. Should you accept an initial settlement, the chances are this would be far less than your injuries and the damage you incurred really merit.

Having legal representation means that all compensation negotiations with the insurance provider are carried out on your behalf by a solicitor. The solicitor would offer essential advice on whether an offer made by AXA Insurance is an acceptable amount or not.

If it is found the amount of compensation offered is less than you deserve, the solicitor would negotiate further with the insurer to ensure the amount offered in a final settlement is higher and therefore, fairer.

For more information on how we could be of assistance in claiming motorcycle accident compensation against AXA Insurance, please get in touch today.

Calculator For Motorcycle Accident Insurance Claims

Insurance providers, courts and solicitors base the amount of personal injury compensation they award injured parties on the Judicial College Guidelines. However, the amount you could receive would depend on several things which include the following:

- The extent of your injuries and how your future life, ability to work and well-being have been affected

As such, it would be hard to provide an exact figure of the amount of motorcycle accident compensation you may be awarded without having all the details beforehand. We have, however, included a table offering ballpark figures on the amount you could receive based on the guidelines mentioned above.

| Injury Type | Notes | Amount of Compensation |

|---|---|---|

| Multiple Fractures of Facial Bones | Leaving a permanent deformity of some kind | £14,900 to £23,950 |

| Fractures of Jaws (i) | Severe fractures leaving permanent effects | £30,490 to £45,540 |

| Moderately Severe Head Injuries | Leaving disabling injuries such as paralysis or cognitive issues | £219,070 to £282,010 |

| Severe Neck Injuries (ii) | Fractures causing substantial damage | £65,740 to £130,930 |

| Moderate Neck Injuries (i) | Continuing pain from a fracture or dislocation | £24,990 to £38,490 |

| Severe Leg Injuries (i) | Severe damage just short of needing amputation | £96,250 to £135,920 |

| Severe Leg Injuries (iii) | Serious fractures resulting in a long time without weight-bearing, instability and requiring prolonged treatment. | £39,200 to £54,830 |

| Other Arm Injuries (b) | Fractures causing a permanent disability | £39,170 to £59,860 |

| Other Arm Injuries (c) | Injuries causing serious disabilities but there has been good recovery | £19,200 to £39,170 |

| Hand Injuries (b) | Serious damage heavily affecting the function of both hands | £55,820 to £84,570 |

The amounts provided above are for general damages only and do not include any special damages you may be able to claim for your out of pocket expenses.

Check If You Could Claim Special Damages

The out of pocket expenses you incurred as a result of having been injured in a motorcycle accident could be claimed back, but you must provide evidence to support these expenses for AXA insurance to agree on a payout. The proof could be in the form of receipts and other relevant documents relating to loss of income.

Out of pocket expenses paid to claimants in special damages could include the following:

- Medical costs which are not covered by the NHS

- Travel expenses

- Care costs

- Loss of earnings and future earnings

- Home and vehicle adaptations

- Any other expenses connected to the injuries and damages you suffered

To find out more on what you may be able to include in your claim against AXA Insurance, please contact one of our advisers today.

How Our Accident Claims Specialists Could Help You

Making a personal injury claim for compensation against an insurance provider can prove challenging if you are not familiar with the legal process involved. Having to negotiate with legal experts can also be a daunting prospect. However, there are options available to you when filing a motorcycle accident claim which is explained below:

- You could opt to contact a lawyer who does not offer No Win No Fee terms – this means you would have to pay the solicitor an upfront fee and ongoing fees as your case against AXA Insurance progresses

- You could choose to represent yourself which, as previously mentioned, can be a daunting prospect for anyone who is unfamiliar with how personal injury claims are processed

- You may also want to consider working with a solicitor who offers No Win No Fee terms to claimants who have strong, valid claims against a third party. This is where we can be of assistance as our solicitors offer No Win No Fee terms on all cases they agree to take on

No Win No Fee Motorbike Accident Claims Against Insurance Companies

The solicitors we work with offer No Win No Fee terms on all cases they agree to take on. This takes all the worry of paying for legal representation when needed off the table. The reason being the only time you pay a No Win No Fee solicitor is when you are awarded compensation.

The lawyer would need to assess your motorcycle accident claim against AXA Insurance, which would be done in an initial consultation that is free of charge. Once the solicitor is happy that your case is strong, you would be asked to sign a contract known as a Conditional Fee Agreement.

This is often called a No Win No Fee Agreement and it lays out the terms and conditions of the contract, together with the amount that would only be payable once a claim has been settled. The amount would be a small percentage of the amount you receive and is deducted from the compensation awarded. This is known as a ‘success fee’.

Should your case against AXA Insurance be unsuccessful, the amount would not be payable because you signed a CFA with the solicitor who represented you.

Talk To Us About Motorcycle Insurance Claims Against AXA

If you would like to discuss your motorcycle accident claim against AXA Insurance with one of our advisers, we can be contacted in the following ways:

- By telephone on 0800 073 8801.

- By email – office@accidentclaims.co.uk

- By using the online contact form – please click here

Helpful Links

For more information on making a split liability motorcycle accident claim, please follow the link provided below:

Split liability claims explained

If you would like more information on road safety for motorcyclists, please click on the link below:

Motorcyclist road safety advice and accident statistics

For more information on time limits associated with personal injury claims, please follow the link provided below:

Statutory time limits for personal injury claims explained

If you would like more information on how No Win No Fee Agreements work, please click on the link provided below:

No Win No Fee Agreements explained

For more information regarding whiplash injuries, please follow the link below:

FAQ about AXA accident at work and motorcycle accident claims

Could I claim for an AXA accident at work?

If you could prove that your employer, whether AXA or someone else, had breached their duty of care towards your health and safety at work, causing your injuries, you could indeed claim, whether against another employer or AXA. Accident at work claims could be made for a variety of different types of breach of duty of care. For example, you could be eligible to claim if:

- You’ve been injured due to your employer’s failure to train you adequately

- You suffer injuries due to an unsafe workplace

- You’re injured because you weren’t provided PPE that was required to do your job safely

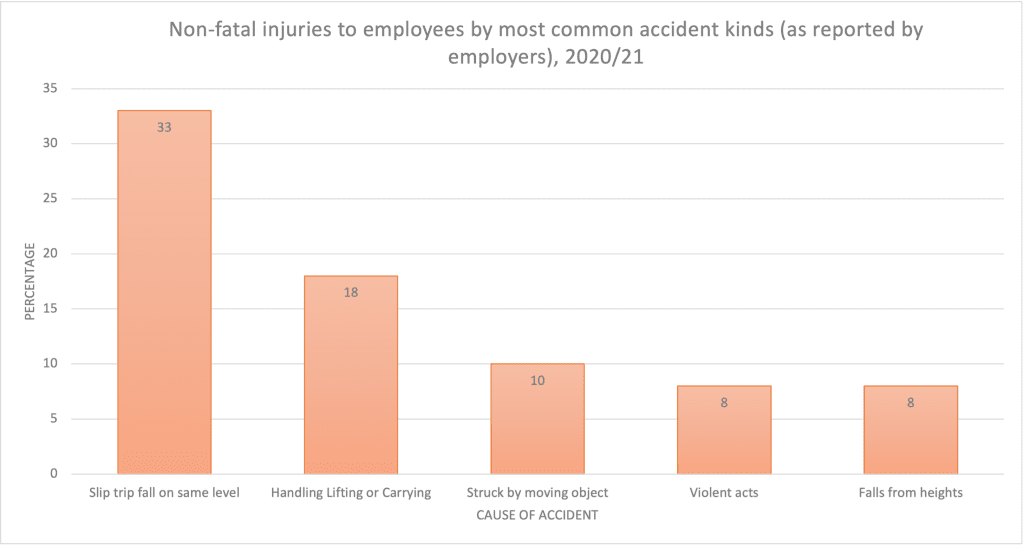

According to the HSE 2020-21 statistics, there are lots of potential accidents that could happen at any workplace, even AXA. Accident at work causes include slips, trips and falls, violence and other incidents, as you can see below.

How can I get help with AXA accident at work claims, or AXA motorcycle accident claims?

We could help with both accident at work claims and AXA motorcycle accident claims. When you call our team, we could ask you questions about what has happened to you. We would do so to gain the information needed to assess your eligibility to claim. Once we have the information we need, we could offer you advice on whether you could make a claim with one of our No Win No fee solicitors. They could assist with your claim for compensation so you can get the payout your case deserves.

Guide by HW

Edited by REB